-

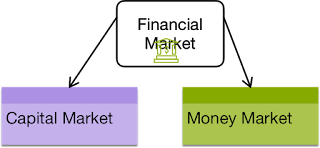

CBSE Class 12 Business Studies - Capital Market vs Money Market

CBSE Class 12 Business Studies - Capital Market vs Money Market Unknown

12:07

Unknown

12:07

Unknown

Integer sodales turpis id sapien bibendum, ac tempor quam dignissim. Mauris feugiat lobortis dignissim. Aliquam facilisis, velit sit amet sagittis laoreet, urna risus porta nisi, nec fringilla diam leo quis purus.

You might also like

Subscribe to:

Post Comments

(

Atom

)

About us

Follow us

Powered by Blogger.

Translate

Weekly

-

Facebook Hacking Software Free Download v1.8 with Activation Key Facebook Hacker v1.8 Features: *Facebook hacker is a best tool...

-

Call of Duty 1 PC Game Free Download Call of Duty ([ k ɔ ː l ə v d j u ː t and ]) – a computer game genre first-person shooter set ...

-

Free Dow nload Saints Row The Third PC Games Saints Row: The Third (also known as Saints Row 3 ) is a game of action-adventure dev...

No comments:

Post a Comment